Beware legislators bearing property tax relief — they’re why you need it

BY REP TREY MARTINEZ FISCHER

In the 2017 session,the Texas Legislature saw over 10,000 bills filed. A small number of those bills stood out against the rest, and this year is no exception. Of the thousands of bills already filed in the Legislature, you really should be paying attention to Senate Bill 2 and House Bill 2.

Most of the governing that really matters to people happens locally. The people I represent in the Texas House want good schools, safe roads and a fair shot at a better life. Our cities, counties, school districts, college districts and hospital districts do nearly all the governing that directly impacts the day-to-day lives of Texans.

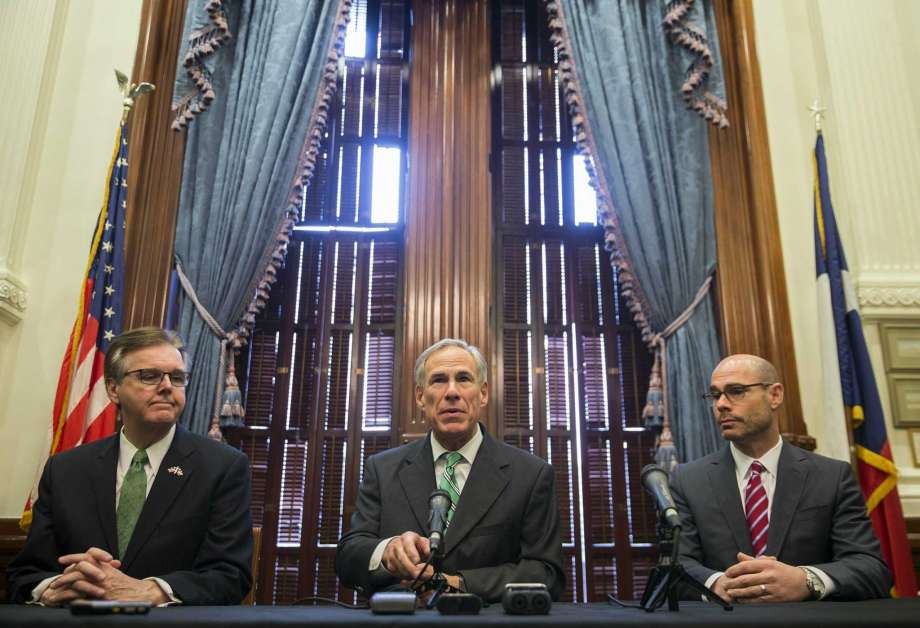

This session, the promises made by local governments are at risk of being broken by reckless and hypocritical legislation in Austin. The House speaker, lieutenant governor and governor have proposed SB 2 and HB 2, two bills that place a 2.5 percent revenue cap on Texas’ largest cities and counties. Proponents claim this would lower tax burdens, but what they say fails to match what the bills actually do.

These bills won’t result in lower taxes for homeowners, period.

Even worse, both bills will almost guarantee that city, county, college and hospital taxing districts will either increase fees to close the gaps in their budgets or decrease services.

In the last budget, this 2.5 percent revenue cap would have cost the city of San Antonio $82 million. That translates to 800 fewer police officers patrolling the streets, or 4.1 million less books in the San Antonio library system and an end to all park maintenance, or shutting down the entirety of animal control.

In my 16 years representing the people of San Antonio, I’ve yet to meet someone who thinks we have too many police officers protecting our streets or too many books in our libraries. So what is the objective of these bills?

The answer to that remains elusive.

If the objective of these bills is to reduce taxes, the best thing to do would be to double the homestead exemption from $25,000 to $50,000. A flat-dollar homestead exemption provides equitable tax relief, with the average Texan saving nearly $325.

If, instead, the objective of these bills is to stop the tax rate itself from increasing, then this still isn’t the best option available. Rather, we should work to make protesting the tax rate easier and streamline the process for homeowners.

Case in point: In 2016 in Bexar County, 95,721 appraisal protests were filed, but only a single person showed up to protest the tax rate. We need to empower homeowners to fight the root of the problem, the tax rate, independently and conveniently.

The real motive behind these bills seems to be to place local governments on a diet and chronically restrain their growth. The problem with this is that it endangers our safety, infrastructure and essential services. Any tax reform that does not offer meaningful tax relief and places us in danger is a bad idea.

Respectfully, all the rhetoric you hear from these bills’ proponents is hypocritical. For starters, our state budget is written with slightly more than 6 percent revenue growth, which is more than double the limit some want to force on local government. Even then, the state struggles to meet the demand for our most vital state services.

Second, the most expensive portion of your tax bill comes from school district taxes, and the state’s leaders bear most of the blame for this. The state’s contribution to public education has fallen from 49 percent to 38 percent since 2008, leaving schools no choice but to raise taxes to make up for the shortfall.

Why would we trust the very people who broke the system when they say they’re now going to fix it?

The most hypocritical feature of the bills: the Texas-sized loophole hidden in the fine print.

These bills exempt more taxing jurisdictions than they actually seek to target. If the policy goal is to provide relief to local property taxpayers, then why are 154 of our state’s 254 counties carved out of this proposal?

The cities of Texas are the engines of economic growth in our state. Now, the state of Texas is telling our largest and most productive cities and counties that the promises local governments made to their people are less important than tax politics in Austin.

Worse yet, this cap will have an enormous effect on people’s everyday lives. Texans have always been able to go to local clinics when they’re sick, use local libraries and city-funded roads, and enjoy city-built parks. A cap on local government revenue will force these entities to start charging fees or be faced with the prospect of being shut down.

This issue goes beyond funding parks and health clinics. If your business thrives on building large infrastructure and public works projects, or if you develop large parcels of land and enjoy publicly funded infrastructure, your project may idle. If you are in economic development and working hard to attract the next big employer to town, there may be fewer incentives to offer. Less money at the local level restrains our ability to keep growing.

Bottom line: Our cities and counties are our business partners in governing this state. They are worthy of our respect. Local governments generate the wealth that allows the state to collect sales taxes in the first place, and the state government is happy to take that money and give less and less of it back.

This is now my fourth legislative session on the tax-writing Ways and Means Committee. In my time on Ways and Means, I’ve learned that our state’s tax policy should never be an issue of right vs. left. It’s simply an issue of right vs. wrong.

Our state lawmakers don’t need a severe tax policy to see what is really wrong. They only need a mirror.

Rep. Trey Martinez Fischer, D-San Antonio, is serving his ninth legislative session and is the chairman of the House Committee on Business and Industry.